19+ take home pay calculator missouri

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Missouri. Utah take home pay calculator.

217 46210 Chilliwack Central Road Chilliwack Bc Apt Condo For Sale Rew

This free easy to use payroll calculator will calculate your take home pay.

. Paycheck Protection Program Guide. Missouri Salary Paycheck Calculator. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Its a progressive income tax meaning the more money. Follow the steps on our Federal. Take home pay calculator oregon.

This Missouri hourly paycheck. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state. 2022 W-4 Help for Sections 2 3 and 4 Latest W-4 has a filing status line but no allowance line.

See where that hard-earned money goes - Federal Income Tax Social Security and. So the tax year 2022 will start from July 01 2021 to June 30 2022. Missouri tax year starts from July 01 the year before to June 30 the current year.

This amount called the wage base can change but it will always be between. Free Federal and Missouri Paycheck Withholding Calculator. The state income tax rate in Missouri is progressive and ranges from 0 to 53 while federal income tax rates range from 10 to 37 depending on your income.

Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. Simply enter their federal and state W-4 information as. Employers pay Missouris unemployment tax.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Use ADPs Missouri Paycheck Calculator to estimate net or take home pay. It can also be used to help fill steps 3 and 4 of a W-4 form.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Colorado take home pay calculator. Supports hourly salary income and multiple pay frequencies.

The first 11000 of each employees wages each year is taxed. Take home pay calculator colorado. Diversity Equity Inclusion Toolkit.

Instead you fill out Steps 2 3 and. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15.

2050 Metcalf Ln Farmington Mo 63640 Mls 22056361 Zillow

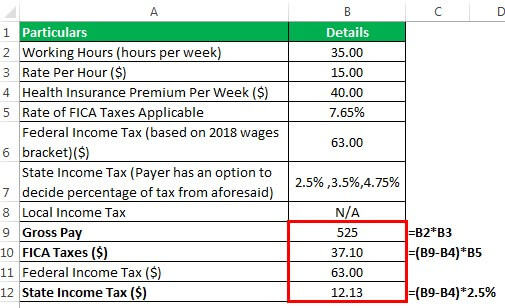

Paycheck Calculator Template Download Printable Pdf Templateroller

The Ridge At Chestnut Apartments 8701 Chestnut Circle Kansas City Mo Rentcafe

The Home Loan Expert Llc Linkedin

739 S Business Highway 13 Lexington Mo 64067 Realtor Com

739 S Business 13 Highway Lexington Mo For Sale Mls 2406026 Weichert

Altitude 970 Apartments 6301 N Klamm Road Kansas City Mo Rentcafe

2i3bbek0hgjndm

Take Home Pay Definition Example How To Calculate

Used 2015 Ram 1500 For Sale In Ballwin Mo With Photos Cargurus

21029 County Road 36 Crosby Mn 56441 Compass

Missouri Income Tax Calculator Smartasset

3610 Page Blvd St Louis Mo 63113 Retail Property For Sale French Frie Factory

Missouri Lawmakers See Opening For Sports Betting During Special Session

Missouri Sports Betting Legislation Will Happen Governor Non Committal On Proposed New Bill

75 Wall St Unit 22 A New York City Ny 10005 Mls Olrs 2001978 Rockethomes

21 Pheasant Ln Scotch Plains Nj 07076 Realtor Com