Unit margin formula

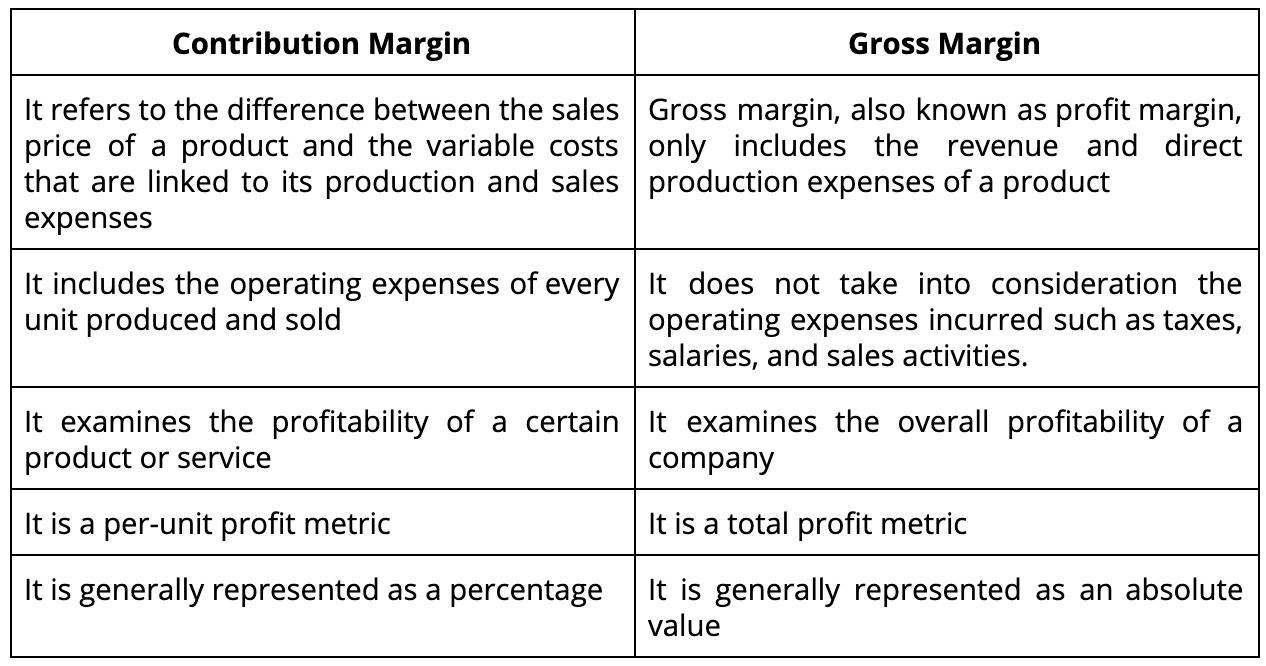

Read more per unit revenue can be more precise in this context. The terminology to understand the formula as mentioned earlier is as follows.

Margin Of Safety Formula Guide To Performing Breakeven Analysis

In the first resort the risk is that of the lender and includes lost principal and interest disruption to cash flows and increased collection costsThe loss may be complete or partial.

. These formulas are implemented based on the given conditions. As you can see Bob has a 250-unit safety buffer from losses. Finally Larrys Lighting adds the variable cost per unit of 15 to their contribution margin per unit.

The unit cost The Unit Cost Unit cost is the total cost fixed and variable incurred to produce store and sell one unit of a product or service. A credit risk is risk of default on a debt that may arise from a borrower failing to make required payments. Heres how these three formulas can be implemented.

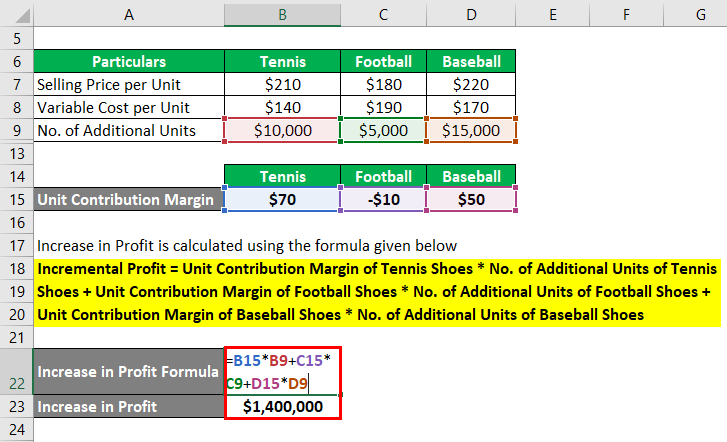

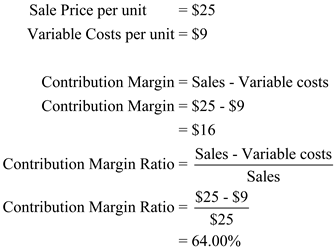

Unit contribution margin per unit denotes the profit potential of a product or activity from the. Provide AmericanBritish pronunciation kinds of dictionaries plenty of Thesaurus preferred dictionary setting option advanced search function and Wordbook. In other words contribution margin per unit is the amount of money that each unit of your product generates to pay for the fixed cost.

Good Company has net sales of 300000. Accordingly the contribution margin per unit formula is calculated by deducting the per unit variable cost of your product from its per unit selling price. He was inexperienced in the business and he feels he has made adequate sales to recover from loss and appears to be making a profit.

Total Costs Total Fixed Costs Total Variable Costs. Contribution margin Sales revenue Variable expenses. You may order presentation ready copies to distribute to your colleagues customers or clients by visiting https.

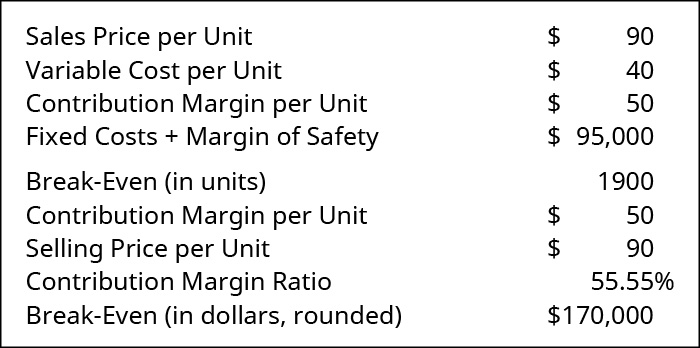

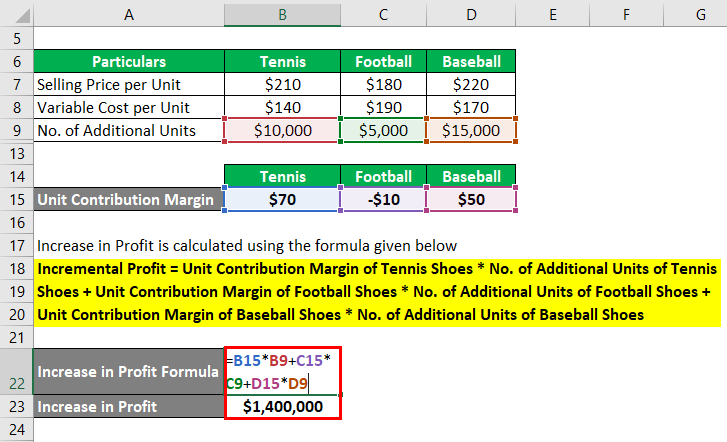

The margin of Safety when total revenue is required margin of safety units selling priceunit. Total contribution margin Number of units sold Contribution margin per unit 5000 units 50 250000. The final step is to calculate the marginal cost by dividing the change in total costs by the change in quantity.

Production volume must be tracked across a specified period. Here are two examples of the selling price per unit. The contribution margin is 6000 - 1000 5000.

Profit Margin 10 Profit Margin Formula Example 2. This lets us find the most appropriate writer for any type of assignment. Selling price per unit examples.

If a jacket had a variable cost per unit of 14 and a contribution margin per unit of 7 the jacket would have a selling price per unit of 21. It has sold 50000 units of its products. Variable costs total 1000.

Get 247 customer support help when you place a homework help service order with us. This ratio represents the percentage of sales income available to cover its fixed cost expenses and to provide operating income to a firm. Unit Price Formula Unit Cost Profit Margin.

More from Cost volume and profit relationships explanations. Type an then click the Margin Cell type a and then click the Sale Price Cell. This page is for personal non-commercial use.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. To Calculate EBITDA Ratio you can use the below formula. 1 Unit Cost.

But this same café also sells muffins. Net Asset Value Formula Example 1. 2 Removes Non-Operating Effects.

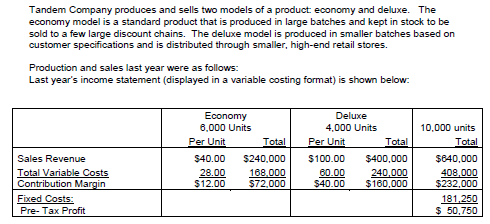

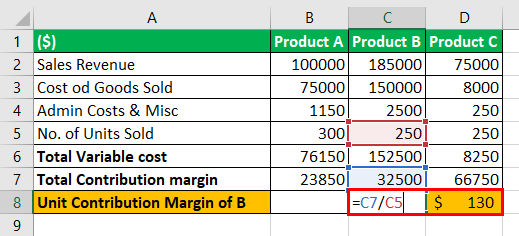

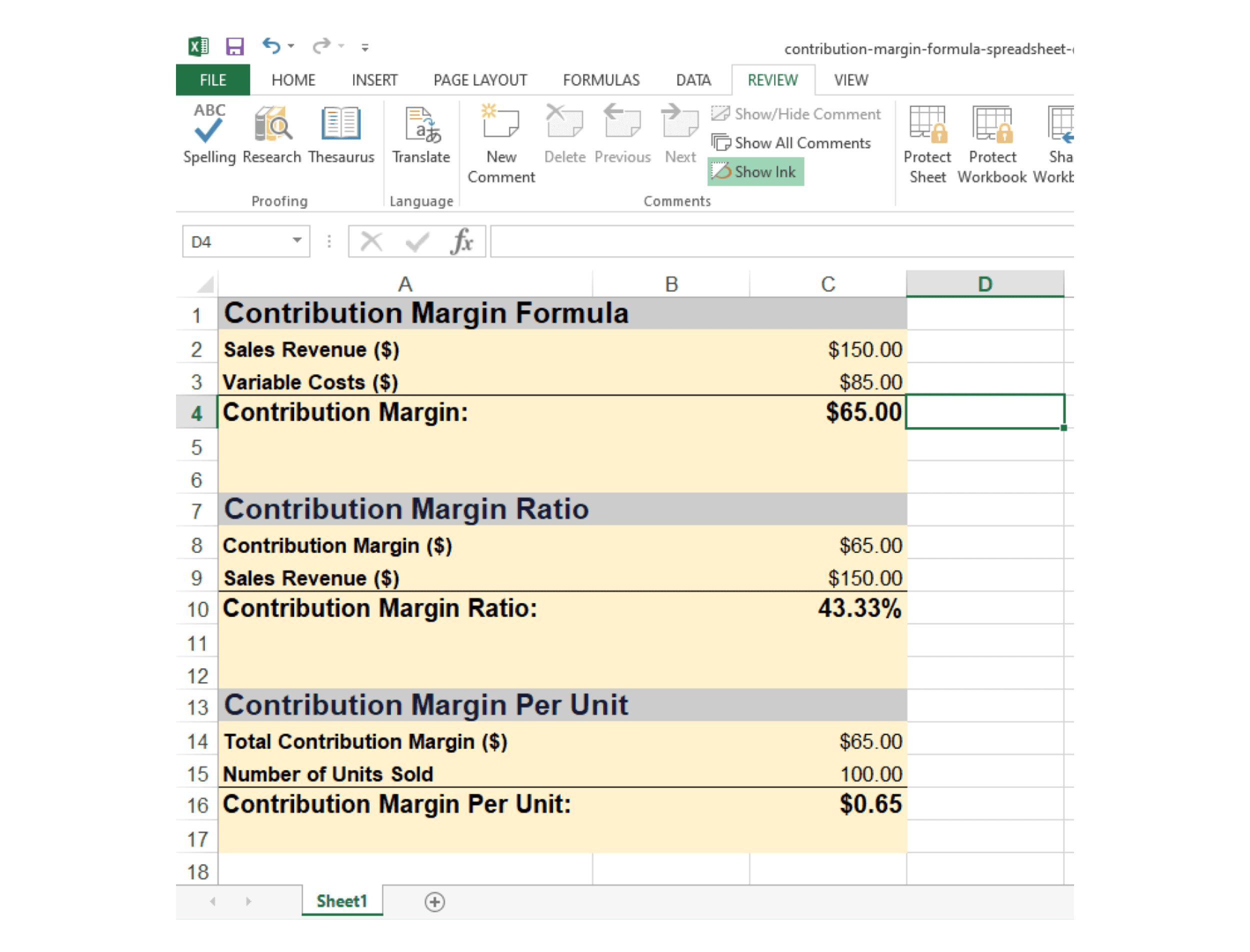

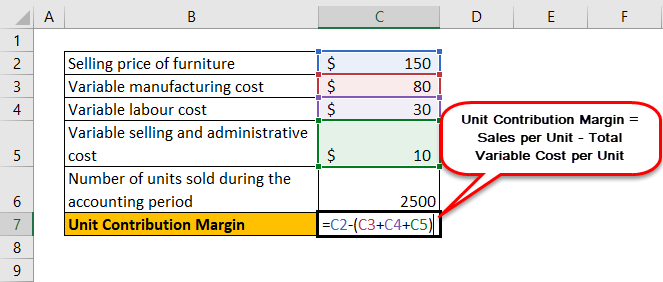

Total contribution margin Sales Revenue Total Variable Expenses. This formula generates the sample size n required to ensure that the margin of error E does not exceed a specified value. As unit contribution margin formula Sales per unit Total Variable costs per unit 150 803010 150-120 30.

Contribution Margin Per Unit Per Unit Selling Price. In other words Bob could afford to stop producing and selling 250 units a year without incurring a loss. In the above example the Total Contribution Margin would be calculated as follows.

The contribution margin ratio shows a margin of 83 50006000. In the example here the formula is. In situations where theres no way we can know the net sales we can use the above formula to find out the contribution.

Conversely this also means that the first 750 units. The margin of safety formula is calculated by subtracting the break-even sales from the budgeted or projected sales. The Revenue from all muffins sold in March is 6000.

Cash expenses paid for direct costs as well as payment is done for funding working capital. The margin of Safety when percentage is asked budgeted sales units breakeven sales unitsbudgeted sales units 100. Next the change in total costs and change in quantity ie.

Alternatively it is known as the contribution to sales ratio or Profit Volume ratio. This means Albert needs to sell 833 pens in a single. Press Enter to calculate the formula.

The variable cost of each unit is 2 per unit. The phrase contribution margin can also refer to a per unit measure. Contribution margin is a cost accounting concept that allows a company to determine the profitability of individual products.

Gautam has started a new business in the gym around a year ago. The break even point formula per unit is equal to fixed costs sales price per unit variable costs per unit. The equation or formula of contribution margin can be written as follows.

Note that the denominator can also be swapped with the average selling price per unit if the desired result is the margin of. The contribution margin ratio shows a margin of 60 600010000. That sounds like a good result.

In cost-volume-profit analysis a form of management accounting contribution marginthe marginal profit per unit saleis a useful quantity in carrying out various calculations and can be used as a measure of operating leverageTypically low contribution margins are prevalent in the labor-intensive service sector while high contribution margins are prevalent in the capital. This means 1000 13 010 833 units. In an efficient market higher levels of credit risk will be associated with higher borrowing costs.

Margin of Safety Formula Accounting-Context Margin of Safety Projected Revenue Break-Even Point Projected Revenue. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. We can represent contribution margin in percentage as well.

The contribution margin Sales price per unit Variable costs per unit Sales price per unit. Let us take the example of a mutual fund that closed the trading day today with total investments worth 1500000 and cash cash equivalents of 500000 while the liabilities of stood at 1000000 at the close of the day. Select the cell that will display the gross margin and divide the margin by the sale price.

Contribution Margin Fixed Expenses Net Income. To solve for n we must input Z σ and E Z is the value from the table of probabilities of the standard normal distribution for the desired confidence level eg Z 196 for 95 confidence. In this example the percentage is.

EBITDA Operating Income EBIT Depreciation Amortization.

Calculating Breakeven Point And Margin Of Safety Download Scientific Diagram

7 3 Margin Of Safety Financial And Managerial Accounting

3 1 Explain Contribution Margin And Calculate Contribution Margin Per Unit Contribution Margin Ratio And Total Contribution Margin Business Libretexts

Unit Contribution Margin Meaning Formula How To Calculate

Stories By Ryan Lasker Contently

Solved 1 Calculate The Contribution Margin Ratio For The Chegg Com

Margin Of Safety Formula Guide To Performing Breakeven Analysis

Contribution Margin Ratio Formula Per Unit Example Calculation

What Is Contribution Margin

Unit Contribution Margin Meaning Formula How To Calculate

Solved Chapter 6 Problem 9e Solution Managerial Accounting 3rd Edition Chegg Com

Contribution Margin Formula And Ratio Calculator Excel Template

Unit Contribution Margin How To Calculate Unit Contribution Margin

Weighted Average Unit Contribution Margin Double Entry Bookkeeping

Contribution Margin What It Is And How To Calculate It

Unit Contribution Margin Meaning Formula How To Calculate

Contribution Margin Ratio Revenue After Variable Costs